Compliance efforts again leveraged to detect, prevent financial crime

The fight against human trafficking is gaining traction. New efforts by European banks and a new bill in the U.S. Senate illustrate how financial institutions might further leverage Compliance efforts to squeeze the financial side of human trafficking.

The European Bankers Alliance and Thomson-Reuters Foundation have created an anti-trafficking toolkit that teaches financial institutions about the red-flag indicators for human trafficking. Alliance members will receive the toolkit.

U.S. Senators Elizabeth Warren and Marco Rubio also announced this week that they are co-sponsoring a bill to further squeeze out traffickers’ access to the U.S. financial system. The senators assert that trafficking worldwide nets perpetrators over $150 billion per year, according to International Labour Organization.

This bipartisan bill proposes the following main points:

- Add financial intelligence and regulatory officers to the President’s Interagency Task Force to Monitor and Combat Trafficking in Persons to increase collaboration between law enforcement and experts in financial crimes.

- Direct federal banking regulators to work with law enforcement and financial institutions to combat the use of the financial system for human trafficking.

- Require the Interagency Task Force to review existing anti-money laundering programs and, if necessary, develop recommendations for Congress and regulators that would strengthen such programs to better target human trafficking. The Task Force will draw on the expertise of the public, private, and non-profit sectors, identifying successful anti- trafficking programs and proposing new measures that will ensure our banking system is not used to facilitate this terrible crime.

The U.S. Financial Crimes Enforcement Network (FinCEN) and U.S. institutions have also worked in recent years to clarify the characteristics of human trafficking and the opportunities for U.S. financial institutions to flag suspicious behavior. FinCEN in a 2014 bulletin distinguishes between the human smuggling of people choosing to immigrate illegally and the human trafficking of individuals enslaved, coerced, or exploited. FinCEN also details the transactional red flags common to each of these types of crime.

For example, human traffickers might exhibit the following behaviors when attempting to move illicit funds through the financial system: abnormal payroll expenditures, substantial deductions to wages, employees’ payroll checks that once cashed are mainly re-deposited to the employer’s account, regular cash deposits or wire transfers in amounts just below the minimum reporting requirement, the appearance of a funnel account, frequent and inexplicable outbound wire transfers, and so on.

The Thomson-Reuters Foundation in a May 2017 story reports that tens of millions of people worldwide are victims of trafficking and are forced to work in the sex trade, farms, factories, fishing vessels, mines, and so on. The foundation asserts that financial institutions can monitor both transactional irregularities that signal financial crime and can also be trained to recognize concerning face-to-face behaviors with individuals at bank branches.

____________________________________

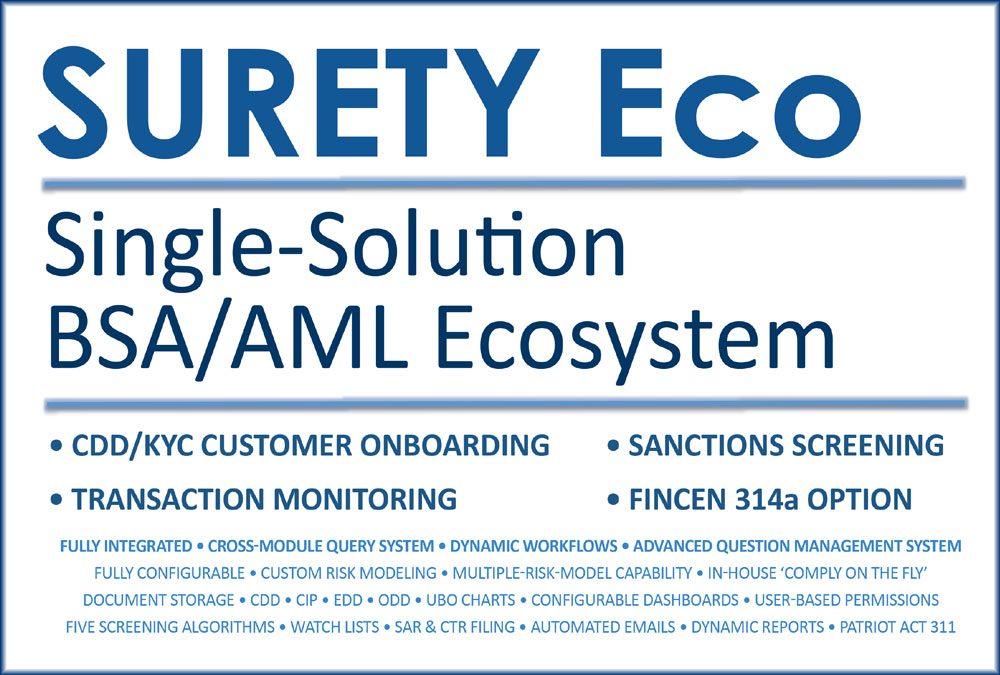

AML Compliance Software Ecosystem–Peak Effectiveness and Efficiency

AML Compliance benefits tremendously from systems thinking, specifically AML ecosystems. If you’re ready to explore the power of the software ecosystem in your AML Compliance work, contact us today to learn more about SURETY Eco, the end to end AML Ecosystem. You’ll be amazed at the power of innovative problem solving and Ecosystem Thinking to transform the effectiveness and efficiency of your AML Compliance efforts and achievements.