Work smarter with no-code platform for AML/KYC & GRC

AML Partners specializes in no-code AML software solutions for AML/CTF, behavioral risk, and workflow processes powered by the RegTechONE platform.

“Delivering exceptional GRC and AML software solutions drives AML Partners. We innovate to fight financial crime and help our clients succeed.”

Frank Cummings

Co-founder and CEO

Jonathan Almeida

Co-founder and COO

Work smarter with no-code platform for AML/KYC & GRC

AML Partners specializes in no-code AML software solutions for AML/CTF, behavioral risk, and workflow processes powered by the RegTechONE platform.

“Delivering exceptional GRC and AML software solutions drives AML Partners. We innovate to fight financial crime and help our clients succeed.”

Frank Cummings

Co-founder and CEO

Jonathan Almeida

Co-founder and COO

Trusted by leading financial institutions around the world

Achieve exceptional AML Compliance, KYC CDD, & GRC on AML software platform

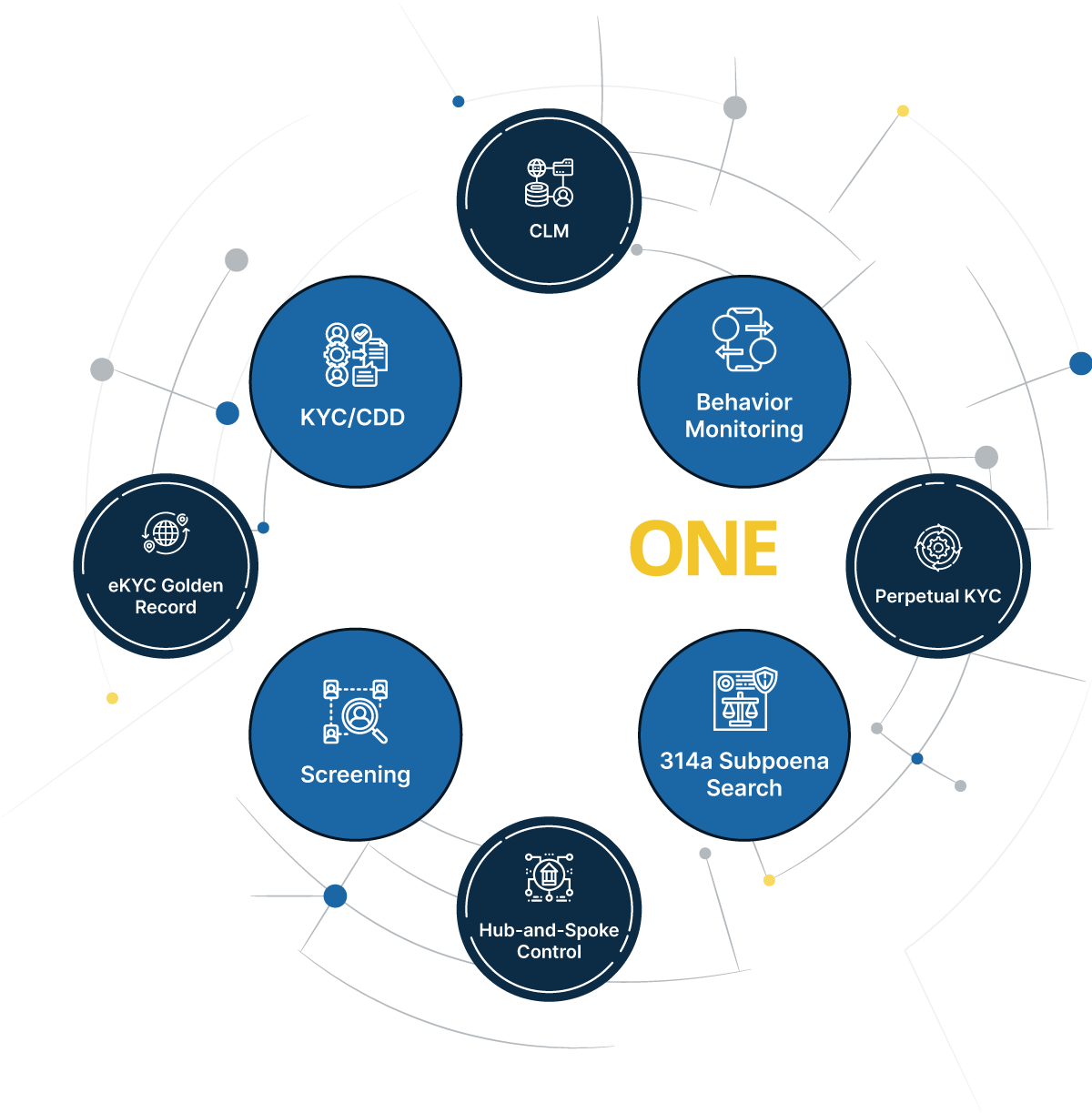

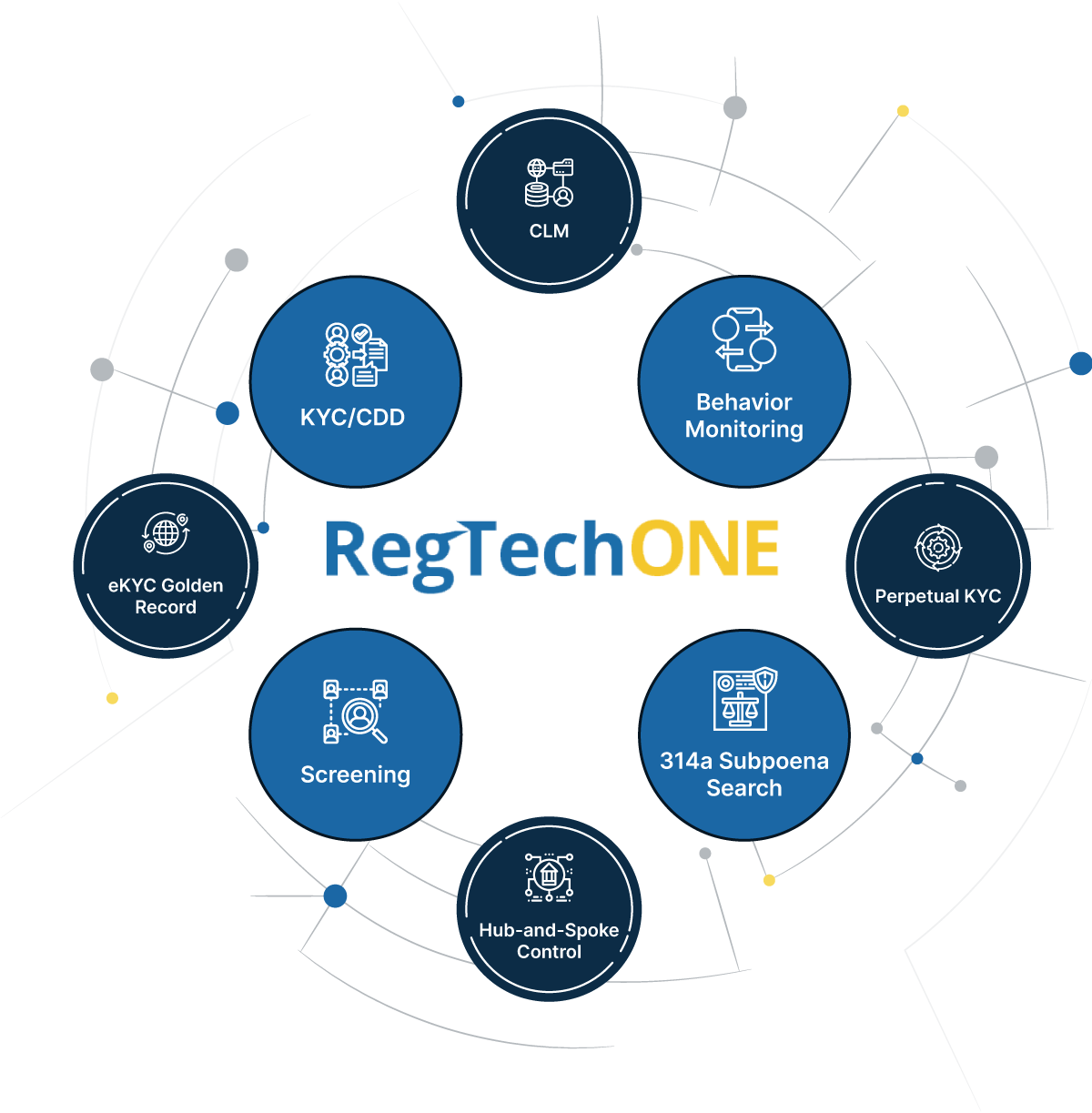

RegTechONE delivers complete fully-integrated AML Compliance software or stand-alone KYC CDD software, Behavior and Transaction Monitoring software, Sanctions Screening software, and FinCEN 314a/subpoena search software. Contact us today to describe your needs and arrange a Proof of Concept. We will demonstrate how RegTechONE delivers complete AML Compliance software—in ways that work for You.

No-code Control

Create and evolve your AML Compliance software workflows–on the fly–with no-code configurability.

API-Driven

RegTechONE leverages APIs to create a Network of Applications for all your RegTech and AML software tools.

Whiteboard Architecture

Design your ideal GRC and AML software system—your workflows, your Risk, your Everything.

Market Insight on RegTechONE™

Explore advantages of modular solutions for AML Compliance

Chartis’ recent analysis of the RegTechONE™ platform pinpoints the competitive advantages of modular AML solutions in a holistic anti-FinCrime system.

Discover how modular options on RegTechONE improve cost-effectiveness, reduce time to market, elevate scalability, and improve accuracy.

RegTechONE delivers exceptional GRC & AML Compliance software and Risk Management software to financial institutions of every type.

RegTechONE: The Power of Everything in AML software for any financial institution

Commercial Banks

Money Service / Remittance Businesses

Securities Firms

Fund Administrators

Law Firms / Trust Banks

Insurance Companies

Central Banks / Financial Intelligence Units

Vendor Managers

Our clients leverage RegTechONE’s extraordinary no-code configurability to design AML software uniquely tailored to their specific needs. With RegTechONE, the platform is the solution for AML Compliance & GRC.

Leverage RegTechONE for your entire GRC & AML software solution

RegTechONE is your complete GRC & AML software solution. Create and edit workflows and KYC collections, configure Risk Ratings, align Event and Action Libraries to your Key Risk Indicators, enable Perpetual KYC or eKYC Golden Record. RegTechONE manifests your vision for AML Compliance software and GRC solutions.

No-code Configuration

Achieve exceptional automation in your AML software via configuration and Comply on the Fly technology. When regulations change, end-users simply update workflows.

Choose Your Tools, Apps, & Data

RegTechONE integrates all your modern AML software tools in ONE platform. Achieve a Network of Applications for exceptional automation and efficiency in ONE AML Compliance software platform.

Leading-Edge Use Cases

Our platform architecture enables new options for optimal GRC & AML Compliance software. Explore use cases like eKYC Golden Record and Perpetual KYC to learn more about our AML software solutions.

Innovate with eKYC Golden Record, Perpetual KYC, Hub-and-Spoke Control, and more

RegTechONE makes it possible to achieve your vision of ideal GRC & AML software solutions. RegTechONE users scale up or down based on need. Institutions with multiple locations leverage eKYC Golden Records and Hub-and-Spoke options in their AML Compliance software. And users can benefit from Perpetual KYC options that deliver near-real time Risk Monitoring. What can ONE do for you?

Client Lifecycle Management software: Workflows & Risk for every CLM stage

Client Lifecycle Management software (CLM) on the RegTechONE platform features robust client lifecycle management. Users leverage workflows for Customer Relationship Management (CRM), onboarding, credit-risk analysis and legal review, and offboarding. The fully integrated workflows provide exceptional Risk Management, automation, accuracy, and efficiency in Client Lifecycle Management solutions for financial institutions.

End-to-end Client Lifecycle Management System

CLM on the RegTechONE platform starts with CRM workflows specific to the sales process and ends with offboarding workflows that protect the institution from illicit activity at the end of the client relationship.

Exceptional Risk Management at Every CLM Stage

The RegTechONE platform features powerhouse Risk tools that elevate Client Lifecycle Management results. CLM workflows on RegTechONE enable institutions to flag and monitor concerning Risk-relevant elements that require close attention.

RegTechONE: GRC & AML Solutions

All-inclusive AML software on feature-packed AML platform

Automate and customize your GRC & AML Compliance software with RegTechONE—Your Work, Your Way. RegTechONE is the single AML software solution.

End-to-End AML Software

Choose RegTechONE for a fully integrated AML Compliance software solution–every element of AML Compliance in a single no-code solution.

KYC Software Solution

Automate your KYC software onboarding with no-code workflows and platform automation for low-touch accuracy and efficiency.

Behavior and Transaction Monitoring Software

Configure RegTechONE’s comprehensive and flexible Behavior and Transaction Monitoring Software for peak Risk Management.

Sanctions Screening Software

Configure our sanctions screening software for automated data services and to minimize false positives. Screening also includes PEPs and Adverse Media.

FinCEN 314a Subpoena Search

Streamline and integrate your FinCEN 314a compliance. Module provides fuzzy-logic screening with a fully encrypted workflow.

Risk Data Service

Risk Data Service delivers quarterly geographic-risk data for country risk and U.S.-specific HIDTA and HIFCA risk.

Know Your World due diligence for AML drives Legitimacy Lifecycle

Financial institutions achieve peak Risk Management with a Know Your World (KYW) approach to due diligence. With AML software modules on RegTechONE, end-users assess, monitor, and manage Risk specific to each category of the Legitimacy Lifecycle. Know Your World with GRC and AML solutions on RegTechONE.

No-code configuration for automated Risk Monitoring

Configure workflows to monitor and respond automatically to your Key Risk Indicators and Key Performance Indicators. RegTechONE’s AML modules make possible automated monitoring according to end-users’ precise preferences for each KYW Risk category.

Near-real time Risk Monitoring

RegTechONE’s AML software modules enable all the features of Perpetual KYC for continuous automated monitoring of Risk in your Legitimacy Lifecycle. With no-code configurability, end-users can edit their Know Your World workflows as needs and circumstances evolve.

Dynamic Case Management

RegTechONE offers fully integrated Dynamic Case Management. RegTechONE enables end-users to integrate 3rd-party tools and analytics in dynamic workflows. Integrate and automate on RegTechONE for exceptional case management in your GRC and AML software solutions.

What’s your vision for Digital Transformation?

Share with us what you want to accomplish. When we understand your vision, we can show you how RegTechONE can be your foundation for successful Digital Transformation.

Your foundation for full Digital Transformation

RegTechONE’s platform architecture delivers Digital Transformation for all your business processes. Through no-code configuration and platform functionality, RegTechONE integrates all disparate processes into a single business stream. Examples of some of the business processes our clients have included in their Digital Transformations include the following:

- Client Lifecycle Management (KYC)

- Fraud Case Workflow

- Centralized Case Management (CMS)

- Crypto Alert/Case Investigation

- Perpetual Customer Risk Assessment

- Loan Initiation, Review and Approval

- Vendor management

- Employee On-Boarding

- Payment Authorization

- Monthly NHL renewal processing workflow

- Small Group New Business Quoting workflow

- Contributions workflow

Design your ideal process, integrate your preferred tools, and leverage no-code configurability. RegTechONE aligns to your preferences. Analyze, streamline, and update your business processes to achieve your ideal Digital Transformation.

“Mashreg has worked with AML Partners not only to develop a ‘1 KYC Golden Record’ solution, but also an end-to-end workflow that enables customer onboarding, periodic KYC updates, multiple stakeholder review, and electronic customer outreach for information and document collection. The entire workflow is digital, automated, and configurable using AML Partners’ no-code platform.“

Amith Rajan

Head Wholesale Digital, Data & Analytics

Mashreq

Read Case StudyStrategic partners in AML Compliance Software Solutions and GRC

Start achieving more today.

We are so confident in the power of RegTechONE to transform your AML Compliance software and GRC efforts that we will demonstrate it to you with a Proof of Concept. Contact us today to experience all the ways that RegTechONE is The Power of Everything in AML software, KYC software and GRC RegTech.