The hidden tax of technical debt in AML Compliance

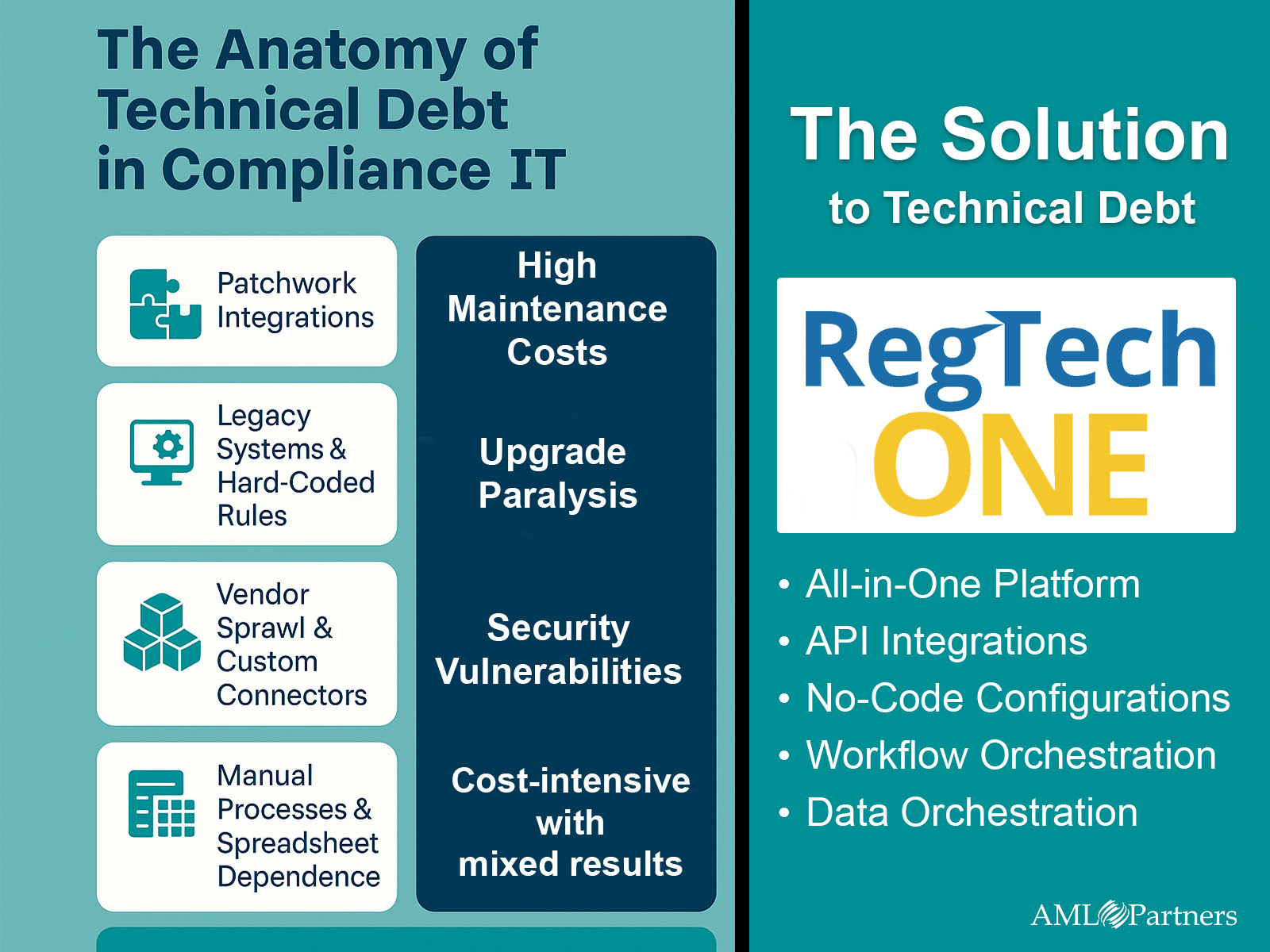

Every year, compliance teams pour budget and talent into keeping brittle systems alive—bolting on yet another sanctions‑list connector, writing custom scripts to sync KYC files, hiring consultants to untangle spaghetti code. The result is a growing mountain of technical debt in AML Compliance that drains resources, delays innovation, and exposes institutions to regulatory risk. Our infographic lays out the anatomy of that debt: patchwork integrations, legacy systems, vendor sprawl, and spreadsheet-driven fire drills that lead to high maintenance costs, upgrade paralysis, security gaps, and chronic compliance exposure.

As McKinsey notes in its 2023 report on failed digital banking transformations, legacy‐system technical debt is a primary culprit behind timeline overruns and compliance gaps. And that problem will only grow with the furious pace of technical advances in AI.

Why patch‑and‑pray model worsens technical debt in AML

Most “solutions” only add more pieces to the puzzle—a new screening engine here, a workflow widget there—while the core stack ages beneath the surface. Each point solution creates another interface to map, another upgrade path to monitor, another invoice to pay. Over time, the cost curve bends the wrong way: Operating expenses rise while agility and effectiveness fall.

One platform to rule them all–and tame technical debt

RegTechONE flips that curve by replacing bolt‑ons with an all‑in‑one, no‑code platform that natively unites data integration, screening, risk analytics, monitoring, workflow, and reporting. Built on a micro‑services architecture with open APIs, RegTechONE absorbs new data feeds or AI models without rewrites—turning yesterday’s liabilities into tomorrow’s launchpads.

From drivers of technical debt to eliminators

| Drivers of Technical Debt in AML | How RegTechONE Removes It |

| Patchwork integrations | Universal, API‑first data gateway with drag‑and‑drop mapping |

| Legacy hard-coded rules | No‑code logic builder and dynamic risk engine |

| Vendor sprawl and custom connectors | Single license covering screening, pKYC, monitoring, workflow, and reporting |

| Manual processes and spreadsheets | End‑to‑end workflow orchestration and data orchestration with automated escalations |

From technical debt to technical leverage

Because users configure RegTechONE themselves—no SQL, Python, or specialized consulting required—new regulatory rules or product lines roll out in hours, not quarters. Early adopters report:

- Up to 90 percent savings of time spent on manual case reviews after moving to Perpetual KYC (pKYC).

- 40–60 percent lower total cost of ownership versus multi‑vendor stacks, thanks to reduced license fees and outsourced development.

- Near‑real‑time risk insight as data, screening hits, and KRI shifts flow through the same orchestration fabric.

Beyond AML: Future‑proof GRC

RegTechONE is not just an AML upgrade; it’s a full GRC operating system. Institutions extend the same no‑code toolkit to policy management, audit, vendor due diligence, and various reporting—all on a platform already vetted for security, scalability, and regulatory rigor. Consolidating these functions multiplies the debt‑reduction effect: one data model, one user experience, one path to innovation.

The business case in one line

Every dollar you invest in RegTechONE goes to new capability, not keeping yesterday’s tech on life support. That is the essence of technical‑debt‑free compliance.

Ready to trade burden for leverage?

Explore a live demo and a proof of concept to see how RegTechONE decommissions legacy KYC silos, automates pKYC, and frees your team to focus on higher‑value investigations. Stop paying the hidden tax of technical debt—start compounding value instead.