Conceptual frameworks in AML Compliance: Your foundation for action–and guardrails for Risk

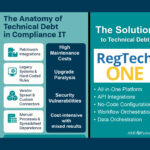

A patchwork approach to AML Compliance can become exhausting. Exhausting to explain, exhausting to integrate, exhausting to coordinate, exhausting to adapt to changing regulations. In a word: Exhausting.

Part of the problem, according to AML Partners CEO Frank Cummings, is that patchwork approaches to isolated AML problems lack a conceptual framework. A conceptual framework can guide decision-making and produce a long-term and comprehensive system of AML Compliance.

“Understanding and confidently articulating your conceptual framework for AML Compliance is key,” Cummings said. “It’s what you build on—it’s your foundation and your frame. It’s what will deliver for you a smart, adaptable, and comprehensive AML Core Compliance Program. For us, that framework is the Legitimacy Lifecycle.”

According to Cummings, the Legitimacy Lifecycle takes a financial institution’s client from onboarding through risk monitoring through offboarding. And it does so in a manner that ensures that legitimate customers with legitimate activity pass through their system with the least amount of interruption–while capturing and reporting suspicious activity as it occurs.

Cummings’ Legitimacy Lifecycle provides the conceptual framework for AML Partners’ customers and for its line of top-shelf AML software solutions, including KYC CDD onboarding, transaction monitoring, and sanctions screening.

“The Legitimacy Lifecycle drives the intelligence and logic of our AML Compliance consulting and the software solutions found in our RegTechONE platform loaded with AML Compliance software,” Cummings said.

“It breaks into lifecycle stages the ‘life’ of a customer account relative to Compliance requirements, and it makes explicit the core AML actions for each stage,” Cummings explained. “The beginning of the customer lifecycle requires excellent KYC CDD. The maintenance phase of the lifecycle requires smart and efficient behavioral monitoring. And the end of the customer relationship requires Compliance-minded offboarding.”

“With our Legitimacy Lifecycle as a conceptual framework underlying our AML Solutions, institutions can be confident that their customer relationships are based on legitimate data and legitimate behaviors,” Cummings said.

For a detailed discussion of the Legitimacy Lifecycle as a conceptual framework for your AML Compliance program, contact AML Partners today. We can walk you through the logic of an end-to-end AML Core Compliance Program, and we can demonstrate how our RegTechONE platform with AML software modules can meet your AML Compliance needs at every stage of a customer’s Legitimacy Lifecycle.