Cross-border transactions introduce sticky complexities into AML Compliance and KYC/CDD. The varied priorities of each jurisdiction manifest in their financial systems, regulatory frameworks, and geopolitical necessities. For financial institutions who regularly process cross-border transactions, exceptional RegTech solutions remain crucial.

Jurisdictional Variations

Jurisdictional variations provide a prime example. Different countries choose their own AML regulations and reporting requirements. This requires financial institutions to pay close attention to transactions that involve parties from multiple jurisdictions. Cross-border compliance obligations may conflict or overlap. Institutions need AML solutions that can accommodate jurisdictional variations via automated processing and jurisdictionally appropriate data sharing.

Currency Conversion and Risk of Exchange-rate Fluctuations

Cross-border transactions often involve currency conversion. This also adds complexity to AML Compliance. Fluctuations in exchange rates can impact the value of transactions, and this can obscure the underlying financial activity. Because monitoring for possible illegal activity relies heavily on the amounts of transaction, having clear and reliable transaction amounts remains a cornerstone of AML Compliance. RegTech solutions that can automate the handling of currency conversions and exchange rates support the efficient identification of suspicious patterns or anomalies.

Fragmented Data Sources

Fragmented data sources amplify the difficulty of obtaining comprehensive and reliable data. In cross-border transactions, financial institutions need to gather information from a range sources. These sources might include government agencies, international databases, and foreign banks. Each of these sources can be expected to use its own format and standards. Integrating and reconciling this disparate data requires sophisticated data management capabilities. The best AML solutions and RegTech platforms provide exceptional data handling with maximum automation.

Correspondent Banking Relationships

Correspondent banking relationships remain key to facilitating international payments in cross-border transactions. However, correspondent banking relationships introduce additional AML risks. This is a problem when financial institutions have limited knowledge of underlying parties and transactions. Ensuring the integrity of correspondent banking relationships requires comprehensive due diligence on correspondent banks. Strong AML solutions help automate and monitor correspondent banking relationships in order to mitigate this risk.

Sanctions Compliance

Global sanctions regimes that continually ebb and flow add yet more complexity to cross-border transactions. Financial institutions must screen transactions against sanctions lists maintained by various governments and international organizations. Governments around the world require financial institutions to be the front line in preventing sanctioned individuals, entities, and countries from accessing the global financial system.

However, navigating the intricacies of compliance with global sanctions challenges virtually every institution. Multi-point solutions require full integration of an excellent RegTech solution, regulatory expertise, robust data management practices, and effective collaboration with internal and external stakeholders.

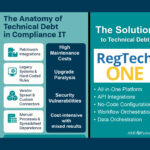

AML Compliance Solutions on a RegTech Platform

Cross-border AML Compliance benefits tremendously from best-in-breed RegTech solutions like RegTechONE. Institutions that proactively identify peak solutions can succeed at mitigating AML risks associated with cross-border transactions. RegTech solutions that deliver effectively and efficiently on cross-border compliance should deliver on the following:

- No-code workflows configurable by end-users to align precisely with each relevant jurisdiction’s specific requirements

- Fully integrated AML Compliance modules that maximize automation and permissioned data sharing in KYC/CDD, transaction monitoring, and sanctions screening

- Dynamic risk modeling configurable by end users

- API connectivity to maximize integration of preferred tools and data subscriptions

- Outreach portals for customers to submit KYC/CDD data

- High levels of no-code configurability to that institutions may update question collections, monitoring, risk modeling, etc. as jurisdictional requirements evolve

- Automated event and action libraries to monitor for key risk indicators and related

- Options for AI and machine learning integrations

- Dynamic Case Management fully integrated into overall system and with maximum automation

- Robust whitelisting and de-duplication capabilities in sanctions screening and transaction monitoring