By Frank Cummings, CEO

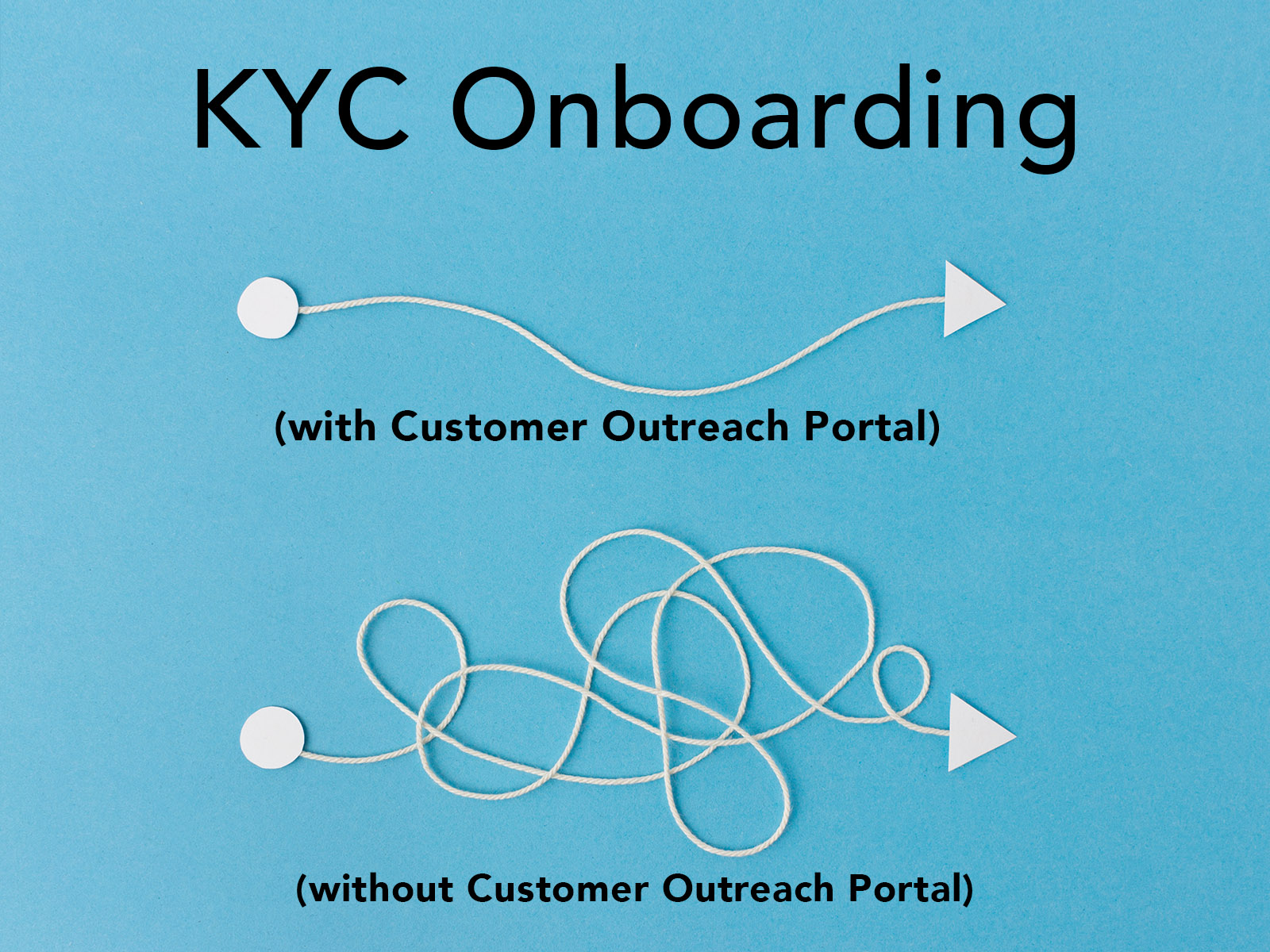

KYC onboarding for commercial accounts requires a tremendous amount of data—and lots of headaches for both institutions and prospective customers. With a ‘customer outreach portal,’ financial institutions can create an onboarding experience that saves time and resources—and that improves the experience for customers during onboarding and periodic review.

Faster Onboarding, Better Experience, Lower Cost

Customer outreach portals provide for institutions massive opportunities to lower costs, improve speed of onboarding, and improve the experience for potential customers.

Unlike small retail accounts that require minimal onboarding information, onboarding corporate accounts can require 600+ pieces of information and documentation. Our RegTechONE platform’s customer outreach portal gives potential commercial customers the opportunity to provide their KYC information at their convenience and as speedily as they wish. Instead of a KYC collection for commercial onboarding taking six weeks, it can take less than a day.

RegTechONE institutions simply create—without coding—a workflow designed to collect submissions of all necessary information and documents. Relationship managers then share that workflow with prospective customers via an email. The email will include a security key that provides access to a link where the prospective customer can populate their KYC collection.

Customer Outreach Portal Security

Our RegTechONE platform features a secure and easy-to-use customer outreach portal for KYC onboarding and periodic review. The customer-outreach option differs sharply from a customer login option. The customer outreach portal provides much greater security for financial institutions and customers alike.

RegTechONE’s customer outreach portal offers no login capability, and it does not offer any broadcast capabilities either. Rather, the customer outreach portal maximizes security by acting exclusively as an onboarding utility not otherwise integrated into the system.

With the customer outreach portal, a relationship manager (RM) needs only the prospective customer’s name, address, telephone number, and email address. The RM can then initiate for the customer a self-onboarding process using the customer outreach portal.

How the Customer Outreach Portal Works

RegTechONE includes a default Customer Onboarding Workflow. Authorized users at the institution can configure and adapt the default workflow in any way they choose, or they can start from scratch—no coding required.

Once the institution has finalized its no-code onboarding workflows, they are ready for use by Relationship Managers. RMs simply send prospective commercial customers an email with an encrypted key. RegTechONE will set that secure key in the customer outreach portal, and it will then wait to receive its matching key. RegTechONE receives that matching key when the prospective customer executes the link in the email sent to the customer.

When the security keys match, RegTechONE will present to the customer the set of required KYC information and documentation the customer needs to provide. The customer completes the questions in the portal link, and they can upload all required documents there, too. This self-onboarding process permits the prospective customer to work as quickly and conveniently as they themselves prefer. And the Relationship Manager can await the completion of the self-onboarding collection.

Further, the security key has a time marker on it so that it expires if not used within the time allotted by the institution. If a security key expires before the submissions are complete, a customer may request that the RM send a new email with a fresh key and link. The customer may then resume the process of providing all the required information—without losing any of their prior work on the self-onboarding documentation.

RegTechONE’s controller type for the portal faces the internet. This means that once a customer completes all conditions for submission, RegTechONE transfers the portal-submitted data into RegTechONE and posts it to the customer record immediately.

At that point, RegTechONE can send the Relationship Manager a message that the self-onboarding is complete. The user institution can also choose whether to configure RegTechONE to kick off another process like risk rating, screening, or whatever.

Customer Outreach Portal for Periodic Reviews

The Customer Outreach Portal delivers efficiency during each customer’s periodic review process, as well. RegTechONE end-users can create a no-code workflow specifically for customer submission of documents that must be renewed.

The same process applies: The Relationship Manager sends the customer an email with a security key and link to a portal site specific to their periodic review. The customer self-updates as required. And when the customer submits the updates through the portal, RegTechONE notifies the appropriate person at the financial institution.

Learn More about Customer Outreach Portal Today

We at AML Partners are committed to providing high-value RegTech solutions for our customers. Faster, cheaper, better KYC onboarding is one of those high-value obsessions for us, and our Customer Outreach Portal is a game-changer in KYC onboarding. We invite financial institutions to reach out to us to learn more about the Customer Outreach Portal. See how the RegTechONE platform provides faster, cheaper, and better customer onboarding—for you and your prospective clients.