Money-saving AML Compliance relies on strategic attention to details of Risk, Risk mitigation

AML Compliance and KYC have long and well-earned reputations as money pits for financial institutions. But the weight of high-stakes federal laws and global regulations make AML/KYC non-negotiable. Unfortunately, this has led some institutions to a mindset of being held hostage to the impossible, i.e. keeping all criminals everywhere out of the global financial system. Legions of expensive consultants have helped maintain that status quo—the more they convince you to do, the more you need to retain them. But money-saving AML Compliance and KYC onboarding lie within every institution’s reach.

I have worked at a high level in AML Compliance and GRC since the 9/11 terror attacks that launched hardcore global AML/CTF. I am telling you that AML/KYC does not need to be a bottomless money-sucking pit. In fact, institutions can both save money and make money with excellent practices in AML Compliance. Here’s how…

1. Commit to an excellent Enterprise Risk Assessment

The most successful and profitable institutions with regard to money-saving AML Compliance embrace the hard yards when creating their Enterprise Risk Assessments. The Enterprise Risk Assessment provides the foundation for the highest-quality and most cost-effective Risk Mitigation.

Too often, institutions shy away from the foundational work of the deep dive required to create a comprehensive and spot-on Enterprise Risk Assessment. Some institutions treat it as busy work or the time-suck that takes away from more immediately profitable directions. And some institutions just turn over their Enterprise Risk Assessment to consultants who seek the work. These consultants, however, rarely have the necessary depth of knowledge of an institution’s book of business. And consultants often rely on doing their work in a way that generates more work—and maybe generates work that never ends.

It’s easy to see the appeal of turning over the work of an Enterprise Risk Assessment to people willing and somewhat able. But all too frequently, the short-term gain of outsourcing an Enterprise Risk Assessment results in long-term expense and frustration due to an assessment that inadequately identifies finely-grained actual risk in favor of blanket-style generalized risks. A finely-tuned Enterprise Risk Assessment provides the foundation for money-saving AML Compliance.

One of the biggest truths in my years of working with financial institutions is that no two are exactly the same. Every institution has a unique combination of key risk factors—like products and services, geographic risk, both the ‘to’ and ‘through’ locations of their transactions, and so on.

When financial institutions commit to a finely grained and highest-quality Enterprise Risk Assessment, they are committing to tremendous savings of money, time, and frustration over the long run. When their competitors are scrambling to monitor for every risk everywhere, they will be monitoring only for the risk they actually have.

2. Create your exact Risk Mitigation Plan

With an excellent Enterprise Risk Assessment in hand, an institution can create a Risk Mitigation Plan that is both tight and effective. This is the second key to money-saving AML Compliance. An institution that understands its actual risks precisely can mitigate those actual risks at a high level—and they can track their performance in real time.

Institutions that lack a strong assessment might find themselves mitigating for the risks they have—and also the risks that other institutions have. When financial institutions cast a wide net of Risk Mitigation, they are casting an expensive net. And these costs pile up over weeks and months and years like a never-ending chain-reaction car crash on a fast-moving highway. Institutions likely find that they are paying for the super-deluxe Risk Mitigation Plan when what they actually needed was a fraction of that.

This is another area in which institutions often turn to consultants to get a Risk Mitigation Plan in place easily and quickly. But it’s a quick win that leads to costs and losses that pile up over time. Casting too wide and too imprecise a net in a Risk Mitigation Plan illustrates the antithesis of cost-saving AML Compliance.

In contrast, institutions that invest their best thinking in their Enterprise Risk Assessment and the follow-on Risk Mitigation Plan thrive over time. They spend strategically to mitigate the Risk they actually have. They do not spend to mitigate the myriad risks that exist in other institutions with other books of business.

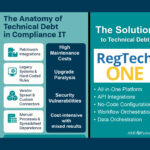

3. Identify AML RegTech that aligns to your needs

With a rock-solid Risk Mitigation Plan as a guide, financial institutions should then seek out AML RegTech solutions that align precisely to their mitigation requirements. Think for a moment about how you identify perfect fits in other parts of your life. When you have lots of choice, you strive to find the right fit for your own needs. A person living in New York or central London, for example, would never choose a big SUV as their primary transportation even though that might be the perfect choice for a person with different needs. The right fit applies to RegTech choices, as well.

Institutions that know exactly what they need in their RegTech can narrow their search and define their needs to vendors. And we find that proof-of-concept opportunities provide excellent insight for institutions. When you know your needs, you can challenge your prospective vendors to show you how their AML solutions achieve your Risk Mitigation challenges—not challenges in general.

Again, money-saving AML Compliance requires that institutions are mitigating for their exact risks. They should not be spending a dime or any time mitigating risks that they do not have.

4. Align your AML solution precisely to your plan

Finding RegTech that will mitigate your exact risk to your specifications is the first technology challenge. The next is commit to working with your vendor during implementation to align the solution to your plan. A great RegTech solution remains a cornerstone of money-saving AML Compliance.

Some institutions want to turn their implementation process over to consultants because it can feel like a slog. But again, investing in the foundational work during implementation results in major savings and efficiency over time.

Here again, consultants can be a help or a hindrance. Some consultants will slow or complicate the work in order to ensure more work over a longer time. I can’t help but think of the saying “Many hands make light work.” But this is not building a barn or clearing out a house for a move. Institutions best serve their bottom line over time if they commit their best thinking to successful implementation.

For example, a detailed Business Requirements Document (BRD) will help an institution get exactly what it wants the first time and on time. A strong BRD—like a strong Enterprise Risk Assessment–may feel like a lot of work. But it’s the foundation to a successful implementation. And a successful implementation moves an institution into efficient, effective, money-saving production that pays tremendous dividends over time.

5. Maximize automation and efficiency measures

Have you ever had a vehicle or a piece of tech that has a lot of bells and whistles but you never get around to learning how to use them ? That happens sometimes with today’s high-tech RegTech. Taking full advantage of automation and efficiency features requires an up-front investment. And it requires that the Risk Mitigation Plan and Implementation are providing a strong foundation.

RegTechONE, our high-powered KYC/AML solution, offers a wide range of automation and efficiency features. Users can automate monitoring and screening, leverage a customer-KYC portal that is also great for periodic reviews, create registries of principles, monitor for KRIs and KPIs, and so much more.

But like high-tech vehicles or home technologies, high-tech RegTech requires attention to detail and to taking on the requisite learning and planning. It’s another example of investment of time and attention upfront that delivers money-saving AML Compliance over weeks and months and years.

Further, your best RegTech solutions will be highly configurable and adaptable so that they can change as your needs change. You want your RegTech solutions to be a major player in your cost/benefit equations over time. That requires both choosing and using to maximum effect.

6. KYC/AML’s data trove a boon for business analysis

So much about saving money in KYC/AML relies on precise Risk Mitigation in the most efficient ways. But the work of KYC/AML also produces a trove of invaluable data for a financial institution. Institutions can save money via KYC/AML by using in-house data to better sell their products and services—and not buy subjective marketing data from outside sources. Financial institutions that leverage this opportunity are one Machine Learning model away from knowing anything they need to know to target-market their products and services to their customers.

An institution that tunes into this data can gain insights into their customers’ evolving needs and how their products and services might evolve. Business intelligence tools with machine learning can help institutions make sense of their data and provide more and better services to their customers and prospective customers. And this is with in-house data—not generalized data purchased from marketing vendors.

Providing to clients a better banking experience more tailored to their own businesses and developing business needs can be predicted to result in a stronger and longer banking relationship. And streamlining the AML/KYC experience on the customer side will help develop stronger banking experiences and client loyalty.

Conclusion: Six steps to money-saving AML Compliance and KYC

To summarize, there are six key elements for financial institutions to consider:

- Commit to an excellent Enterprise Risk Assessment

- Align your Risk Mitigation Plan to your Enterprise Risk Assessment

- Identify AML RegTech solutions that can mitigate your specific risks

- Align and configure your chosen RegTech precisely to your Risk Mitigation Plan

- Maximize automation and efficiency available in your RegTech

- Leverage KYC/AML data to understand and market to your customers’ needs

KYC/AML doesn’t need to be the money pit in your financial institution. With strong commitments to achieving high-quality foundational elements of your AML program, institutions can maximize efficiency and save tremendous amounts of resources over time. And with business intelligence applied to in-house data, institutions can understand their customers’ current and evolving needs and work to meet those needs.

So much of money-saving AML Compliance hinges on upfront efforts to build strong foundations. Institutions that commit to these strong foundations can regain control of both the costs and the benefits of their Compliance efforts. And they don’t have to feel strangled by risks and practices that don’t apply to their own books of business.