AML/CTF Compliance difficult to enforce in ‘holes in the vast online financial world’

Ebay and PayPal made the news last week—in an affidavit about a terror-financing sting. American Mohamed Elshinawy pleaded guilty on Tuesday to charges that included providing material support to ISIS. The two giants of online commerce had secretly been used by the Islamic State to transfer terror funds to Elshinawy, according to the Wall Street Journal.

FBI investigators first turned their attention to Elshinawy when known Islamic State members wired him $1,000 via Western Union. Agents scrutinized his every move after that and eventually determined that he had received nearly $9,000 to be used for terror attacks in the U.S.

As part of his efforts to hide the transfer of terror funds, Elshinawy pretended to sell computer equipment on EBay. IS members in a British cell ‘purchased’ this pretend equipment and made ‘payment’ to Elshinawy via PayPal. The Wall Street Journal reported that both firms cooperated with investigators and each emphasized their commitment to and extensive efforts in preventing illegal use of their services.

An earlier Journal report noted that this appears to be a case of terror financing that illustrates the “holes in the vast online financial world” and the exploitation of these holes by the Islamic State.

While more traditional financial institutions like banks have been subject to extensive global AML/CTF Compliance enforcement, the less formal, less ‘standard,’ and more numerous methods of money exchange have often not yet been subject to rigorous AML/CTF Compliance regulations and examinations.

While these non-banking methods of transferring terror funds tend to be limited to much smaller amounts, a systematic and regular process of small transfers can quickly accumulate, as in Elshinawy’s case. This is particularly worrisome when attacks by individuals or small groups can be planned and carried out with relatively small resources.

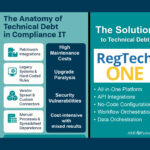

RegTechONE: AML Software platform for Peak Effectiveness and Efficiency in AML and GRC

With AML Partners’ platform technology for RegTech, updating and upgrading your AML and eGRC software solutions is easier, faster, and much less expensive. Contact us today to explore how platform technology and our end-to-end AML Ecosystem powered by the RegTechONE platform–can transform the efficiency and effectiveness of your unique AML Compliance efforts. RegTechONE software for AML Compliance includes fully integrated modules for CDD KYC software for on-boarding, behavior and transaction monitoring software, and sanctions screening software for comprehensive AML screening. And AML Partners simplifies your end-to-end fully integrated AML Compliance efforts even further with an optional Subpoena Search module for FinCEN 314a and similar subpoena searches. Contact us today to learn about our proof-of-concept option or schedule a demo of RegTechONE, the AML software ecosystem. With extraordinary configurability and built for API extensibility, the RegTechONE AML software platformpowers not only an end-to-end AML software solution but also vendor management, AML client lifecycle management, eKYC Golden Records, Perpetual KYC, and so much more.